Medigap:

What You Need To Know

Medigap is insurance sold by private insurance companies that fills the gaps in Original Medicare. When you choose to enroll in a Medigap plan, your primary coverage is still Medicare (Parts A and B), and your Medigap plan becomes your secondary coverage.

Any facility or provider that accepts Medicare must take your Medigap plan, regardless of the company that provides your coverage.

Medicare covers roughly about 80% of the cost of medical procedures and you are responsible for the remaining 20%. The Medigap plan you choose can help cover these remaining expenses.

Medigap does not cover prescription drug costs. Individuals that choose to enroll in a Medigap plan will also want to enroll in a stand-alone prescription drug coverage known as Part D coverage. Part D is provided by private insurance companies. During the Annual Election Period (AEP) from October 15th – December 7th you can change your Part D coverage without impacting your Medigap coverage.

Don’t Get Cooked Alive By Rising Premiums In Your Medigap Plans

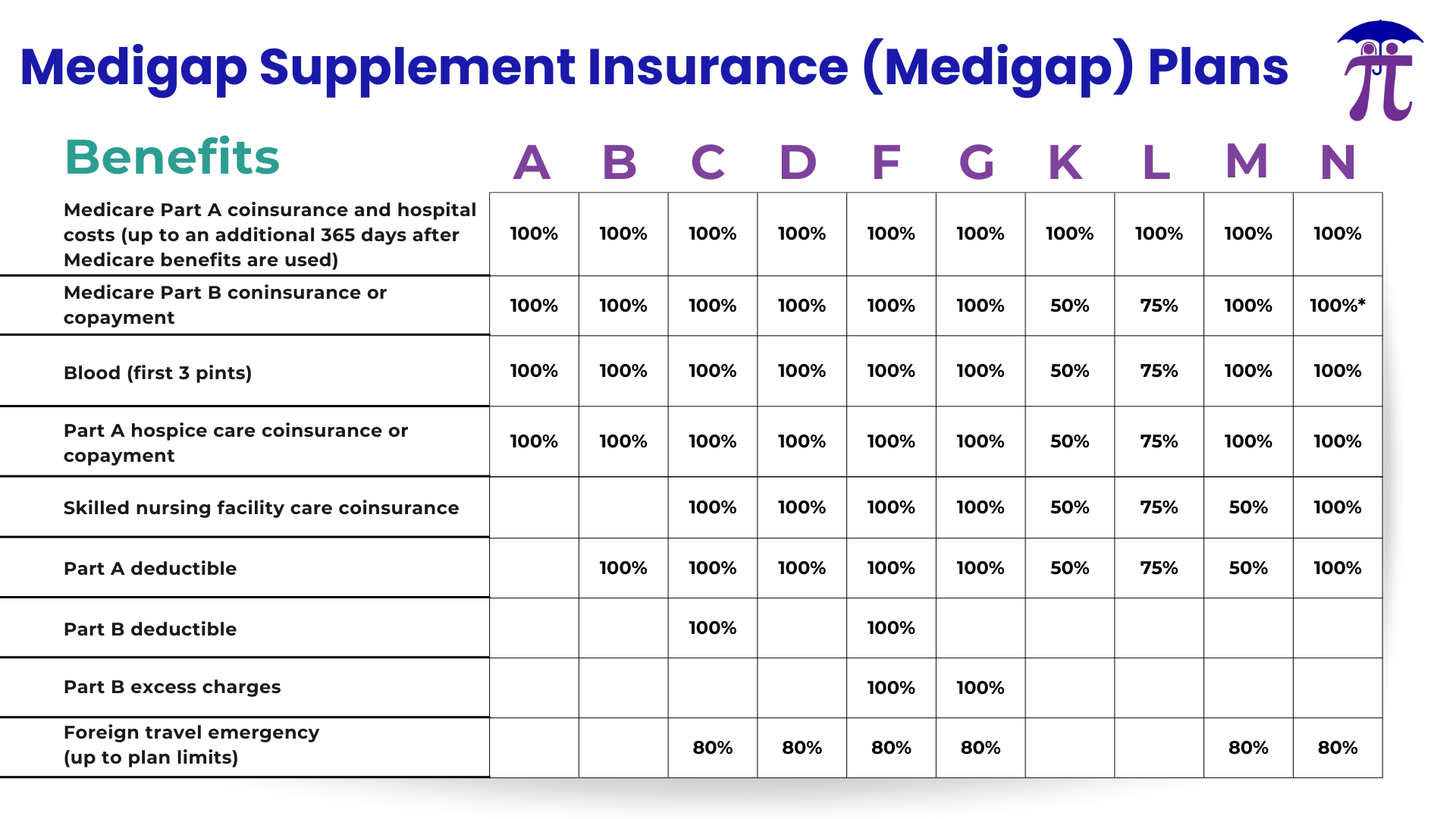

Insurance companies are only allowed to sell you “standardized” Medigap policies that all must follow federal and state laws. All policies of the same letter offered must provide the same benefits even if offered by a different private insurance company and generally, the only difference between Medigap policies of the same letter (Example: Plan G sold by a different private insurance company can have a different premium but will have the same deductible and copays) sold by different insurance companies is the cost.

Medigap coverage generally has higher fixed monthly premiums, but lower variable out-of-pocket costs. Monthly premiums and out-of-pocket costs depend on which standardized Medigap plan you select.

Example: Plan F covers all the out-of-pocket medical costs for Medicare-approved procedures; however Plan G will cover the same out-of-pocket medical costs only after you have satisfied your once per calendar year Part B deductible.

Along with higher monthly premiums, Medigap’s premiums also increase during the lifetime of your Medigap coverage. Your plan premiums typically increase by a few percentage points every year due to various factors.

Rate increases depend on how your plan is “rated.” The three main types of Medigap premium “ratings” include Attained Age, Issue Age, and Community. We can help you find the different rating options available to you in your zip code!

Types of Medigap

Medigap (Medicare Supplements) plans are typically referred to by a specific letter (ex. Plan G, Plan N, etc.). There is no difference in base benefits when comparing the same lettered plan, no matter the private insurance company that supplies it.

If you are under a strict budget, different plans may work better for your needs. Plans G and N cover most of the costs remaining after Medicare has paid their portion. This means that your out-of-pocket medical costs won’t fluctuate as much throughout the year when you do need to seek treatment.

All standardized Medigap policies are guaranteed renewable even if you have health problems. This means the insurance company can’t cancel your Medigap policy if you stay enrolled and pay the premium.

Medigap plans are not HMOs or PPO’s and therefore do not require you to receive treatment at “in-network” providers for lower-cost treatment. You can seek care at any facility or provider in the country that accepts Medicare.

Medigap plans cover the out-of-pocket costs for treatments and procedures approved by Medicare (Parts A and B). Therefore, Medigap plans typically do not cover extra benefits not provided by Medicare. There are a few exceptions to this. Some Medigap plans do include some coverage for foreign emergency care, which is not provided by Medicare. Additional dental/vision/hearing coverage can be purchased separately to complement your Medigap coverage.

Medigap Open Enrollment

Medigap Open Enrollment period is directly related to the individual. The best time to decide if Medigap coverage is right for you, along with which Medigap plan works best for you is during your Medigap Open Enrollment Period.

Your individual Medigap Open Enrollment Period begins the first day of the month that you are both 65 (or older) and are enrolled in Medicare Part B.

In most states, if you enroll in a Medigap plan outside of your one-time open enrollment, you will have to go through medical underwriting, which includes health questions and possible medical background checks. You may be denied the ability to purchase a Medigap plan outside of your open enrollment period if you have certain pre-existing conditions at the time of your new Medigap application. Every Medigap company has different health underwriting criteria, so give us a call, and we can help you decide which company may be right for you.

Medigap plans come in ten different “standardized” packages, and it is essential to understand which plan best fits your needs!

You might feel overwhelmed trying to enroll into a new Medigap plan, or that the plan you are already enrolled in has left you like a frog in a boiling pot! We are here to help you with any situation you are in. Our agents have more information on all your Medigap options so you can transition through all your Medicare needs with confidence!

By completing and submitting the requested information in this form, you agree to allow a licensed sales representative to contact you regarding information related to Medicare health plans and health insurance plans, products, services and/or educational information related to health care.

Find the Medicare Coverage right for you

We are contracted with all major carriers in the Michigan Medicare market. Using our years of experience we can help you find the coverage that best suits your unique needs.