Find The Right Medicare Coverage

When to Sign Up?

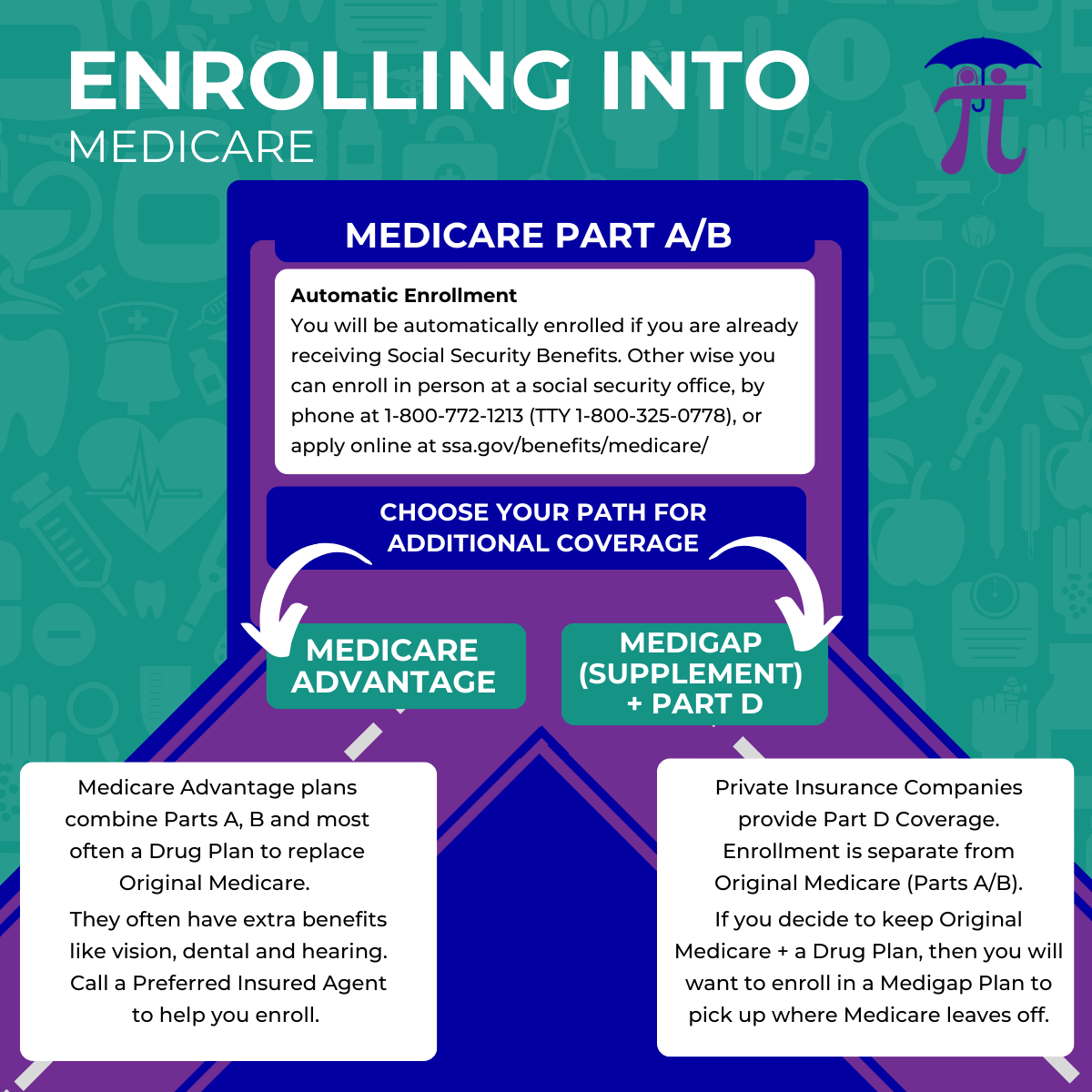

Unfortunately, there is no “one size fits all” for Medicare Plans. When it comes to Medicare eligibility, many people are unsure if it is necessary to sign up, how to start the process, and what plans they need to stay covered. That’s what we are here for, we help you navigate through all these questions and more.

If you are going to be turning 65 in the next six months, it is time to start planning for your Medicare coverage. You should compare the premiums that you are paying, evaluate what the coverage provides you, figure out what the co-pays will be, determine if you need co-insurance, and many other factors unique to your needs.

Part A (Hospital)

While working over the years you will pay into your Part A (Hospital) coverage. The section marked as MCARE on your pay stub was you funding your future Medicare premium-free Part A. Most people will pay no further premium for their Part A coverage if they enroll on time.

If you were/are married to someone that qualifies for premium-free Part A you may qualify based on their record.

Part B (Medical)

When you enroll in Medicare, you will receive a letter from the Social Security Administration with information about your individual monthly Part B premium. It is possible to opt out of Part B, but you would not be covered for doctor’s visits, surgeries, and Part B medications (e.g. chemotherapy) unless you have other creditable coverage. If you purchase Medigap insurance or enroll in a Medicare Advantage Plan, it is also necessary to pay the Part B premium.

Individuals or married couples with higher income may be required to pay an Income Related Monthly Adjustment Amount (IRMAA) in addition to the Part B premium. Individuals with limited household income and assets may be eligible for a Medicare Savings Program where the State would pay their Part B premium.

Part D (Prescription)

Part D plans are prescription drug plans offered through private companies. All of these plans have a monthly premium.

If you were eligible to enroll in a Part D plan and did not have creditable coverage, you may also be required to pay a Part D late enrollment penalty in addition to your Part D premium.

As with Part B, individuals or married couples with higher income may be required to pay an Income Related Monthly Adjustment Amount (IRMAA) in addition to the Part D premium.

Individuals with limited household income and assets may be eligible for an Extra Help / Low Income Subsidy to reduce or eliminate the Part D premium.

Testimonials

Achieve exceptional results with an Agent!

By completing and submitting the requested information in this form, you agree to allow a licensed sales representative to contact you regarding information related to Medicare health plans and health insurance plans, products, services and/or educational information related to health care.